Every January, it starts again.

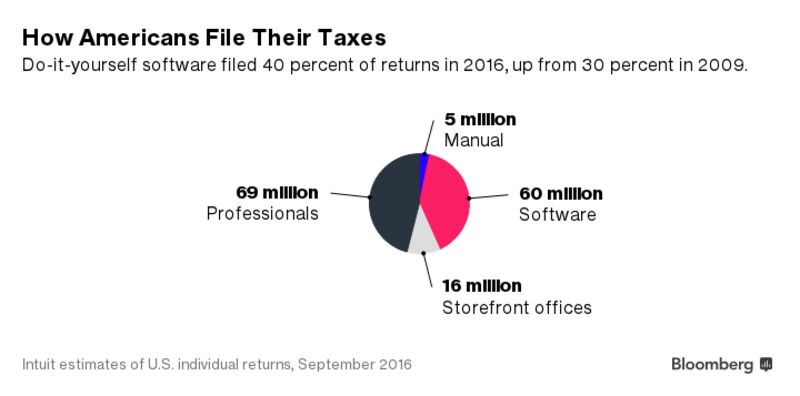

TurboTax battles H&R Block for dominance in tax preparation, while smaller players fight over the rest of the market. Despite the fierce competition, your return should end up looking more or less the same, no matter which service you use. Unless you're wealthy and have a complicated tax situation, your refund should be the same size, too, whether you secure it with a do-it-yourself online service, a storefront preparer, or a fancy accounting firm.

(This assumes that your tax preparer is competent or, if you go online, you don’t make costly mistakes using tax software—not necessarily safe assumptions.)

So the main battleground is price. In 2017, the word of the year is “free.” There are, in fact, good deals to be had, especially if you file your taxes early. The Internal Revenue Service officially began processing returns on Monday.

The trend could hurt profits in the tax prep business, said Oppenheimer & Co. analyst Scott Schneeberger. The tax season is “going to be so hyper-competitive that no one is going to have a great year,” he predicted. The big players are also spending heavily on marketing, with H&R Block hiring Jon Hamm and TurboTax, owned by Intuit, enlisting David Ortiz and Kathy Bates. Adding to the competitive pressures is a new player: The credit-monitoring website Credit Karma just started offering free tax preparation.

As for the consumer, caution is in order. Free doesn’t always mean free.

Tax preparers promise free work on simple returns to get new customers in the door. Taxpayers planning to pay nothing may soon feel the pressure to upgrade. Online tax preparers may charge additional fees for important services such as accessing or importing last year’s return and asking tax questions over the phone. Even as TurboTax spent the last couple of years winning over customers with its “absolute zero” campaign, many customers paid much more than zero. While some do get free tax advice, TurboTax managed to earn an average of $49 per U.S. return in 2015 and 2016, up from $47 in the years before.

The bottom line: If you have a simple tax return, you can probably file truly free of charge through any of the major tax preparers online. Seven in 10 Americans can use tax software through the Free File Alliance, a partnership between the IRS and a dozen tax preparers. The only requirement is an adjusted gross income of $64,000 or less.

For those with more complicated situations, figuring out the best option—the cheapest tax advice that also suits your needs—can require some digging.

Here’s a review of how the top online players—TurboTax, H&R Block, and TaxAct, now joined by Credit Karma—are positioning themselves for the 2017 tax season.

H&R Block

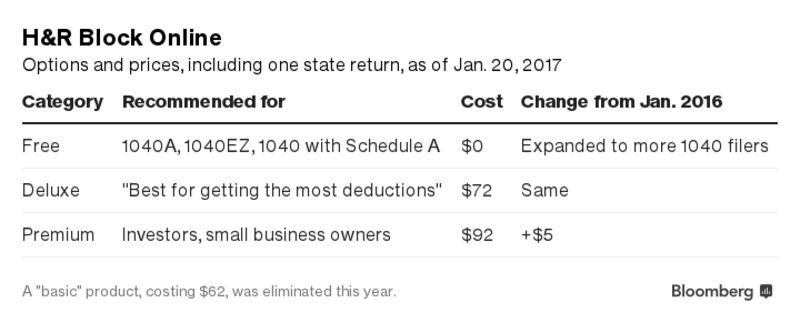

The “big change this year” is H&R Block, said Wedbush Securities analyst Gil Luria. “This year they’ve decided to be very aggressive.” The company made more taxpayers eligible for free tax filing, both online and in its 12,000 storefront offices, and is luring customers with a new refund product.

Why? H&R Block’s chief executive officer is blunt. “We did not have a good year” in 2016, CEO Bill Cobb said in an interview this month. “Everything that could go wrong did go wrong.”

H&R Block processed almost a million fewer returns in the U.S. in fiscal 2016 than in 2015, a 4.5 percent drop to 19.7 million, according to results reported in June.

To combat TurboTax’s “absolute zero,” H&R Block’s 2017 strategy is “more zero.” TurboTax and TaxAct will file basic tax returns—the 1040EZ and 1040A forms—for free. Online, H&R Block is matching that while also filing some regular 1040 forms free of charge, including those for homeowners with home mortgage interest deductions and real estate taxes.

Block’s biggest line of business is off-line. To attract millions of additional Americans to its offices, where it can charge more by offering one-on-one tax help, it is dangling two big lures this year.

The company is offering to process 1040EZ forms for free in person, down from about $50 last year. And taxpayers who show up may be eligible for an advance on their tax returns.

Changes to federal law and IRS procedures mean it could take until late February for early tax filers get their refunds. That can feel like a long time for low- and middle-income families that depend on large refunds, especially from the earned income tax credits and additional child tax credits that involve the longest waits. H&R Block’s Refund Advance program offers filers up to $1,250 of their refund in the form of a no-interest loan.

TurboTax

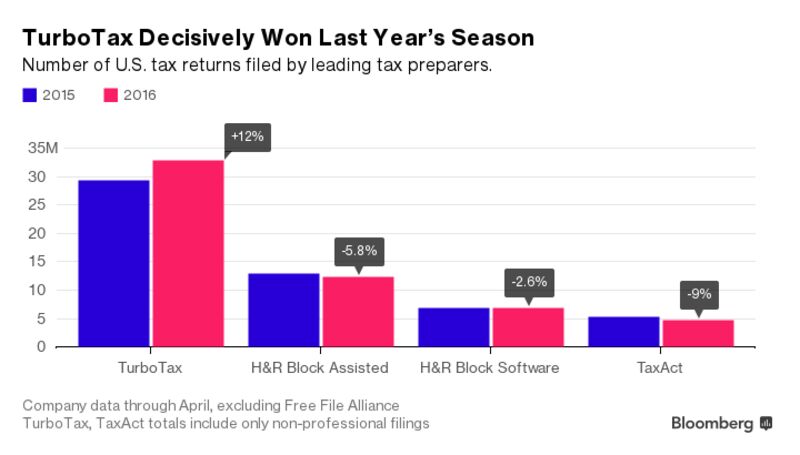

H&R Block’s pain last year was its archrival’s big gain. The division of Intuit decisively won last year’s tax season, with consumer tax revenue up 10 percent in the 2016 fiscal year and U.S. tax filers up 12 percent.

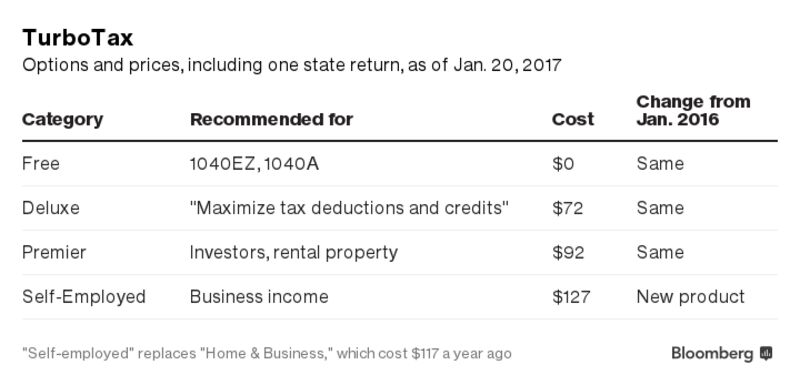

Not surprisingly, TurboTax is more or less sticking to its 2016 strategy. “Our pricing and value proposition is pretty consistent, year-over-year,” said Intuit spokeswoman Julie Miller. For simple filers, the “absolute zero” campaign offers free federal and state 1040EZ and 1040A returns. Those with more complex returns generally will pay more than if they had chosen discount online tax preparers such as TaxAct, though they’ll probably pay a lot less than if they hired someone to do their taxes for them.

In exchange for higher fees, TurboTax customers get higher technology. “We’re really driving a lot of product innovation,” Miller said, citing features such as video chat with tax experts. The company has also focused on shortening the amount of time it takes customers to prepare their taxes through the TurboTax site and apps.

TaxAct

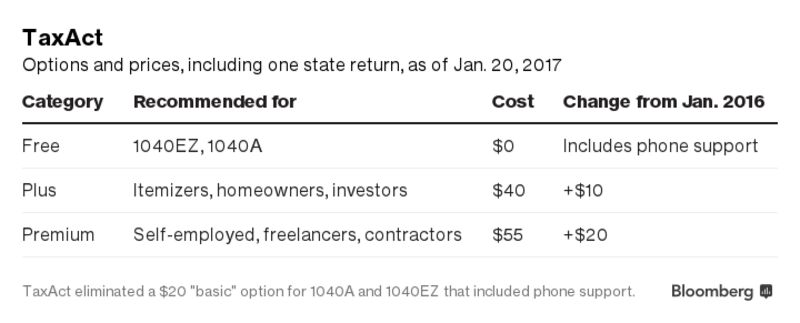

TaxAct, TurboTax’s much smaller rival, generally tries to charge at least 50 percent less than Turbo, with pretty basic technology and design. “We’re really focused on delivering the best value for customers,” TaxAct spokeswoman Shaunna Morgan said.

Nonetheless, this year TaxAct has raised prices. Its “plus” product, aimed at taxpayers who itemize, is starting the tax season at $40 (including both state and federal returns), up $10 from last year. That compares to $72 for TurboTax and H&R Block’s “deluxe” products.

Though TaxAct can’t price itself lower than “absolute zero,” it is trying to make its free product more attractive. This year, for example, it’s offering phone support to simple filers for no charge.

TaxAct is also promising an “upfront price” with “no shady fees.” That means disclosing on the opening screen, for example, that its “free” product includes a $5 fee to import last year’s return. TaxAct argues that it’s being more transparent about the final price you'll pay. And if you start a TaxAct return early in the tax season, you lock in that price. That protects you from increases that are common to all online players late in the season.

Credit Karma

One tax preparation service that won’t be charging any hidden fees is Credit Karma, now promising to do Americans’ taxes completely free. The credit-monitoring site makes money through advertising recommended financial products to consumers.

It’s not the first company to try to enter the online tax prep market with a free or very cheap product, and those historical examples show it won’t be easy, Wedbush’s Luria said. It’s hard for an upstart to attract enough customers. “People need to know the product works,” he said. “They need some confidence that the software can handle their taxes.”

Credit Karma founder and CEO Ken Lin is trying to win over skeptics. To launch the product, the company bought a small tax prep outfit and is hiring hundreds of preparers to offer support by online chat, e-mail, and phone.

One advantage Credit Karma enjoys is its popularity. It has more than 60 million members. Earlier this month, 1.7 million people signed up for a waiting list for tax prep, Lin said. The tax product was opened to the broader public on Monday, just as the IRS officially opened for business.Still, the product won’t address the needs of about 10 percent of taxpayers, Lin said. The software won’t be able to help people with especially complicated situations, such as those with farm income or multi-state tax returns. And there are trade-offs. Tax filers will have to register for Credit Karma, and while Lin said the company doesn’t sell customer information to advertisers, it does recommend ads to users, based on their personal financial data. The site will use your tax information to improve those recommendations, Lin said, though filers with privacy concerns can opt out by declining to "sync up your tax info" early in the process.

No comments:

Post a Comment