Summary

I made a killing by putting my Apple stock in my Roth rather than my IRA where I would have to pay taxes on the gains.

A Roth will never require a minimum distribution from it.

An IRA to Roth conversion only makes sense if you have many years for your earnings to grow tax-free in the Roth.

I have a high income right now, so it makes sense for me to put 100% of my savings in the tax-deferred 401(k) instead of the Roth 401(k).

I want all my money in the Roth because I don't want to have to deal with the forced RMDs required of IRA owners.

Source: Bogle Financial Markets Research Center

How many have ever watched the show Mythbusters? Do you know which of the opening five statements are myths or at least not totally true? Many believe that they understand everything they need to know about Roths, IRAs, and the RMD (Required Minimum Distribution for those IRA owners).

Much like another well-known SA author's recent article titled Dividend Growth Portfolios MUST Have 45 (And Only 45) Positions, not everything is as it seems by just reading the title and the summary bullet points.

My wish is not to try and make you an IRS or tax expert, but to at least give you enough information for you to understand some of the challenges in trying to navigate the environment of what are called tax-advantaged retirement accounts. In doing so, I hope to dispel some myths or at least provoke you to investigate on your own some of the math surrounding these tax-advantaged accounts.

Ground Rules

First, some definitions and abbreviations are in order:

- I will use the term Roth to indicate any number of what are typically tax-advantaged retirement accounts funded with after-tax dollars for which you can withdraw all contributions and earnings tax-free later. These come in many different forms such as the Roth IRA, Roth 401(k), Roth 403(b), and others.

- I will use the term IRA to indicate any number of tax-advantaged retirement accounts funded with pre-tax dollars for which you withdraw all contributions and earnings paying ordinary income tax on them at the time of withdrawal. You could find many types of these such as Traditional IRA, Traditional 401(k), 403(b), SEP-IRA, 457(b), SIMPLE IRA, and others. It should be noted that it is possible to have a mix of after-tax and pre-tax dollars in most of these accounts, but when I use the term IRA from now on, I will only be considering these accounts will all pre-tax dollars in them.

Let's explore what I call the three most common levels of tax advantage that you can receive when investing.

- Level one-half. This typically comes out of what is called a taxable account from the generation of long-term capital gains or qualified dividends. Our current progressive tax code gives these gains a reduced tax rate that results in a reduction in the taxes paid. For instance, if your income is otherwise in the 10-15% tax bracket, dividends and long-term capital gains will fall to the 0% tax bracket, until they fill up that bracket. If your qualified dividends and other income are high enough to move you into the 25-35% bracket, the dividends and capital gains will be taxed at 15% for those brackets. I call it level one-half because there is no reduction on taxes for the deposits put in the account to start. The reductions for even the qualified earnings, while some can be essentially tax-free, this only occurs if you keep your total income and earnings below the 25% bracket point.

- Level one. This level is occupied by both the IRA and Roth accounts which get either a tax break when you put the money in the account or a tax break when you take the money out. As we shall see later, these two accounts are essentially on equal footing from the aspect of after-tax money you can spend in retirement per equal dollars earned while working, if your tax rate is the same both in and out of the accounts.

- Level two. This is occupied by the Health Savings Account, which is known as the HSA. This account when used properly for medical expenses and accompanied by a high deductible health insurance plan will result in two levels of tax savings; one on the money contributed and a second on the tax-free withdrawals when the money is used for IRS approved medical expenses.

This article is only concerned with the level one retirement accounts and how the IRA and Roth can be thought of in most cases as equals. It is true that the Roth and IRA each have unique characteristics that may be appropriate or at least appealing to different investors. The short list of some of these is described below:

Roth:

- Tax deferral on all earnings inside the Roth

- Tax-free withdrawal of all contributions and earnings (subject to a five-year holding period plus age restriction of 59 ½).

- Tax-free withdrawal of your contributions at any time or age from a Roth IRA. A note on this as it applies to employer sponsored plans is that you should check with your plan administrator as each plan has their own set of rules as to when withdrawals are allowed.

- Tax planning flexibility - Since there are no forced withdrawals by age 70 ½, you have more tax-planning flexibility during retirement.

- If a Roth IRA owner dies, certain of the minimum distribution rules that apply to traditional IRAs will apply to the Roth.

IRA:

- Tax deferral on contributions during working years will lower your taxable income while working and can increase some tax credits.

- Increasing some tax credits could actually allow you to save more.

- The required minimum withdrawals must begin prior to April 1st of the year after you turn 70 ½. The RMD for any year after the year you turn 70 ½ must be made by December 31st of that later year. If these are not made, you can incur a 50% penalty on any amount not taken that was due.

- Inherited IRAs have a complete set of RMD tables and rules which will not be discussed here.

There are many other nuances to the above two types of accounts, and even within different types of Roth or IRA accounts, most of which can be found in the IRS publication 590, which has now been split into two parts - pub 590-A (contributions) and pub 590-B (distributions).

Assumptions for Myth Busting

To make what is commonly called an apples-to-apples comparison of these Roth and IRA accounts, we must use the following assumptions:

- Because we can never know what future tax rates will be, each evaluation must be done at the same tax rate for each account, both at the start of the test period and the end of the test period.

- Each evaluation must be done from the aspect of how much money did the investor need to earn to fill the account to begin with.

- For all evaluations, I will assume that the investor earned an extra $10,000 to put towards his retirement savings.

- That his tax rate was always 25% now and in the future.

- This made it possible for him to put either $10,000 into a traditional 401(k) account or $7,500 (after-tax) into a Roth 401(k) account.

Let's now continue on to see if we can bust up some myths.

- I made a killing by putting my Apple stock (NASDAQ:AAPL) in my Roth rather than my IRA where I would have to pay taxes on the gains.

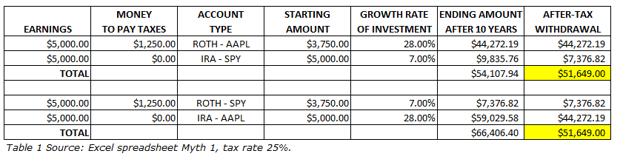

Let's compare some Apple stock with a compounded annual return around 28% over the last 10 years to the S&P 500 (NYSEARCA:SPY) with a return of around 7% over the same time period. Let's put half of the investor's earnings in AAPL in the Roth and the other half of his earnings in SPY in the IRA and then switch them around and see if one produces more after-tax income than the other. Below are the results:

While it could certainly be said that the investor did make a killing from his Apple stock investment over the last 10 years, it had nothing to do with putting it in the Roth - Busted!

2. A Roth will never require a minimum distribution from it.

This is easy, by referencing IRS publication 590-B, chapter 2 - Must you withdraw or use assets? On page 35 of the 2015 version of publication 590-B, it states:

"The minimum distribution rules that apply to traditional IRAs do not apply to Roth IRAs while the owner is alive. However, after the death of a Roth IRA owner, certain of the minimum distribution rules that apply to traditional IRAs also apply to Roth IRAs as explained later …"

This was maybe somewhat of a trick question, because to the owner, he will not have to take a distribution, but down the line, the distributions will eventually need to be taken. Let's call this one a draw depending on your point of view.

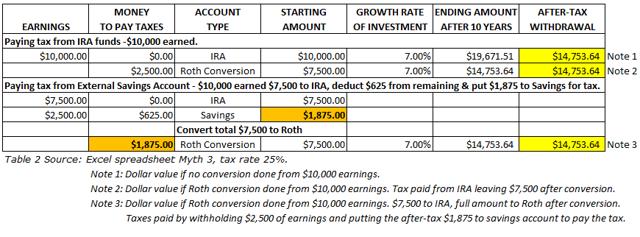

3. An IRA to Roth conversion only makes sense if you have a lot of years for your earnings to grow tax-free in the Roth. Let's also tack on another related comment that frequents this topic - the conversion only makes sense if you don't use the IRA funds to pay the tax but pay the taxes from an external account.

I will make a stipulation to the above that the taxpayer is over the age of 59 ½ so there will be no penalty on early withdrawal to pay the taxes. If you are doing a conversion below age 59 ½ and pay the taxes out of the IRA conversion, you will incur a 10% penalty on the amount of money withdrawn to pay the taxes unless one of a few exceptions applies to you.

Below is a table indicating the results from three scenarios - leaving the money in the IRA, doing the conversion using the IRA money only, and doing the conversion paying the taxes from outside the IRA:

As can be seen from the above, if you make an equivalent comparison by using $10,000 earned in each case, the results are exactly the same in all three cases. The myth that paying the taxes from an outside account is better is - Busted! Also, the number of years you have until you need the money is also irrelevant since all three test cases will end with the same dollar amount given the same growth rates and tax rates for each.

Of course, if you have $10,000 in your IRA and you want to maximize the amount of money you can put in the Roth, then by paying all the tax from an external account, you can get the whole $10,000 into the Roth, but you had to earn $13,333 to do so. Whether your IRA amount is $7,500 or $10,000 the results are always equal when given equal footing.

4. I have a high income right now, so it makes sense for me to put 100% of my savings in the tax-deferred 401(k) instead of the Roth 401(k).

The myth here is that it is a good idea to put 100% of your retirement savings into the IRA and roll-the-dice on the taxes you will pay later. The risk is actually quite high that along the way of a 30-year working career and a 30-year retirement some things can change, the most important of which may be future tax rates. Other things happen in retirement that are usually unforeseen in advance and require large lump-sum payments. If these have to come from your IRA and be taxed as ordinary income, this can certainly raise your tax rate and drain more of your money than anticipated. Finally, if your IRA is quite large, the Recommended Minimum Distributions can become quite large, increasing in size by four to five percent each year starting at age 70 ½ as I outline in this article. This can also put you in a higher tax bracket than anticipated. In this case, the myth that you can foretell the future is certainly busted.

5. I want all my money in the Roth because I don't want to have to deal with the forced RMDs required of IRA owners.

The myth here is that it is a good idea to put 100% of your retirement savings into the Roth and roll the dice that by paying the taxes while you are working that you will have enough retirement money to live off, and second, because this money will be tax-free, other income such as Social Security will be untaxed as well. While this can certainly be the case if you have no other income from pensions, annuities, or taxable investing accounts, when taken to the extreme you can end up with much less total money in retirement, having wasted too much of it on the taxman during your working career. It is always a good idea to have at least some taxable income in retirement to at least fill up the tax-free bucket that the IRS gives, which is basically equal to your standard deduction plus your exemptions. In 2016, for a retired couple, both ages 65 or older, this is $23,200, and for a single person age 65 or older, it is $11,900. Imagine how lucky you would be if you had put some money in an IRA avoiding a 33% tax while you were working and then was able to take it out of the IRA and pay no tax (or a very low tax) when you were retired.

While RMDs can raise your taxable income and your tax rate in retirement, they should not be something that is feared to extremes. In an article I wrote entitled Surviving The Tax Bite of Retirement, I pointed out that over the last five years the personal exemption, standard deduction, and the top of each of the tax rate bracket have grown by around 2% per year. If this should continue into the future, with no other changes to the tax brackets, it would mean that the top of the 25% bracket for a married couple would grow from $151,900 to almost $250,000 should they both be alive for a 25-year retirement. This should be something that is considered when making a blank statement that RMDs are going to throw me into a higher tax bracket in retirement. If RMD withdrawal rates are increasing by 4% and tax bracket inflation is 2%, you would only need about a 2% yearly drawdown in your IRA to keep any tax bracket creep from occurring.

Summary

In my volunteer work helping people with their taxes each season, there are always cases where having some of their retirement in a tax-deferred IRA could have resulted in some tax-free withdrawals from that IRA, due to their low income level. The converse is also often true - that with a Roth account it would have been possible to lower how much of their retirement savings goes to the taxman. It is never a bad idea, in my opinion, to have both Roth and IRA funds going into retirement.

Conclusion

For more detailed information on these subjects covered, I suggest reading at least a couple of times the two IRS publications mentioned at the outset. Understanding the rules can avoid costly mistakes on the road to retirement as well as later when you are in retirement. I have also written an Instablog article titled Roth Vs. Non Roth (401k, 403b, 457, Etc) & The Time Value Of Money, which adds a casino example to the mix which you may find interesting.

This study is only as good as the data presented from the sources mentioned in the article, my own calculations, and my ability to apply them. While I have checked results multiple times, I make no further claims and apologize to all if I have misrepresented any of the facts or made any calculation errors.

The information provided here is for educational purposes only. It is not intended to replace your own due diligence or professional financial or tax advice.

No comments:

Post a Comment