Many people say that a home is the largest single investment you’ll ever make, but consider this: The national median existing-home price was $199,500 in October of this year. That’s less than the estimated $210,388 it will cost to send your two-year-old to an in-state, public college for four years. Thinking about a private college? That’s going to run $465,516 by the time your toddler is ready for higher education.

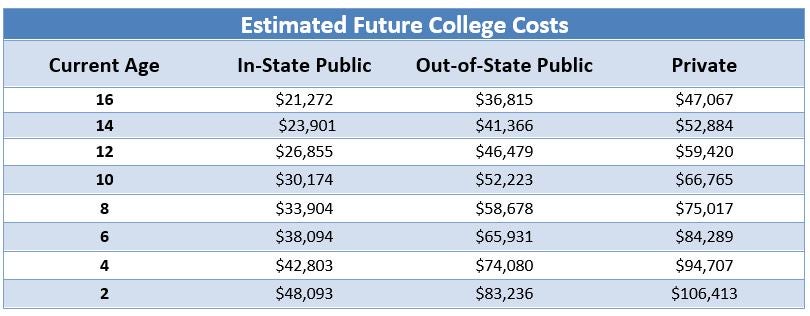

College costs are increasing at about two times the rate of inflation each year – a trend that is expected to continue indefinitely. Here’s what you can expect to pay for each year of tuition, fees, and room and board by the time your kids (or grandkids) are ready to head off to college (assuming a steady 6% college cost inflation rate):

Keep in mind, these numbers represent a single year of costs; the number of years your child attends college will depend on the degree(s) he or she is seeking. While many students will qualify for financial aid, scholarships and grants to help cover college costs, there are still a number of ways to further reduce college costs. One of the easiest ways is to invest the money you’ve set aside for your child or grandchild’s college years in tax-smart investment vehicles. These plans and accounts allow you to efficiently save for your child or grandchild’s education while shielding the savings from the U.S. Internal Revenue Service as much as possible.

529 Plans

“One of the best ways to help a child financially while limiting your own tax liability is the use of 529 college plans,” says Sam Davis, Partner/Financial Advisor with TBH Global Asset Management. A 529 plan is a tax-advantaged investment plan that lets families save for the future college costs of a beneficiary. Plans have high limits on contributions, which are made with after-tax dollars. You can contribute up to the annual exclusion amount, currently $14,000, each year (the "annual exclusion" is the maximum amount you can transfer by gift - in the form of cash or other assets - to as many people as you wish, without incurring a gift tax). All withdrawals from the 529 are free from federal income tax as long as they are used for qualified education expenses (most states offer tax-free withdrawals, as well). There are two types of 529 plans:

- 529 Savings Plans – These plans work like other investment plans such as 410(k)sand Individual Retirement Accounts (IRAs), in that your contributions are invested in mutual funds or other investment products. Account earnings are based on the market performance of the underlying investments, and most plans offer age-based investment options that become more conservative as the beneficiary nears college-age. 529 savings plans can only be administered by states.

- 529 Prepaid Tuition Plans – Prepaid tuition plans (also called guaranteed savings plans) allow families to lock in today’s tuition rate by pre-purchasing tuition. The program pays out at the future cost to any of the state's eligible institutions when the beneficiary is in college. If the beneficiary ends up going to an out-of-state or private school, you can transfer the value of the account or get a refund. Prepaid tuition plans can be administered by states and higher education institutions.

Traditional and Roth IRAs

An IRA is a tax-advantaged savings account where you keep investments such as stocks, bonds and mutual funds. You get to choose the investments in the account, and can adjust the investments as your needs and goals change. In general, if you withdraw from your IRA before you are 59.5 years old, you will owe a 10% additional tax on the early distribution.

However, you can withdraw money from your traditional or Roth IRA before reaching age 59.5 without paying the 10% additional tax to pay for qualified education expenses for yourself, your spouse, or your children or grandchildren in the year the withdrawal is made. The waiver applies to the 10% penalty only, and should not be confused with avoidance of income taxes.

Using your retirement funds to pay for your child or grandchild’s college tuition does come with a couple drawbacks. First, it takes money out of your retirement fund – money that can’t be put back in – so you need to make sure you are well-funded for retirement outside of the IRA. Second, IRA distributions can be counted as income on the following year’s financial aid application, which can affect eligibility for need-based financial aid.

Coverdells

A Coverdell education savings account (ESA) can be set up at a bank or brokerage firm to help pay the qualified education expenses of your child or grandchild. Like 529 plans, Coverdells allow money to grow tax-deferred, and withdrawals are tax-free at the federal level (and in most cases the state level) when used for qualifying education expenses. Coverdell benefits apply to higher education expenses, as well as elementary and secondary education expenses. If the money is used for nonqualified expenses, you will owe tax and a 10% penalty on earnings.

Coverdell contributions are not deductible, and contributions must be made before the beneficiary reaches age 18 (unless he or she is a special needs beneficiary, as defined by the IRS). While more than one Coverdell can be set up for a single beneficiary, the maximum contribution per beneficiary per year is limited to $2,000. To contribute to a Coverdell, your modified adjusted gross income (MAGI) must be less than $110,000 as a single filer (or $220,000 as a married couple filing jointly).

Custodial Accounts

Uniform Gifts to Minors Act (UGMAs) and Uniform Transfers to Minors Act (UTMAs) are custodial accounts that allow you to put money and/or assets in trust for a minor child or grandchild. As the trustee, you manage the account until the child reaches the age of majority, which is between 18 and 21 years of age, depending on your state. Once the child reaches that age, he or she owns the account and can use the money in any manner. That means he or she doesn't have to use the money for educational expenses.

Although there are no limits on contributions, parents and grandparents can cap individual annual contributions at $14,000 to avoid triggering the gift tax. One thing to be aware of is that custodial accounts count as students' assets (rather than parents’), so large balances can limit eligibility for financial aid. The federal financial-aid formula expects students to contribute 20% of savings, versus only 5.6% of savings for the parents.

Cash

The annual exclusion allows you to give $14,000 (for 2013 and 2014) in cash or other assets each year to as many people as you want. Spouses can combine annual exclusions to give $28,000 to as many individuals as they like – tax free. As a parent or grandparent, you can gift a child up to the annual exclusion each year to help him or her pay for college costs. Gifts that exceed the annual exclusion count against the lifetime exclusion, which is currently $5.25 million.

Concerned about the lifetime exclusion? As a grandparent, you can help your grandchild pay for college, while limiting your own tax liability, by making a payment directly to his or her higher-education institution. As Joanna Foster, MBA, CPA explains, “Grandparents can pay directly to the provider the educational expense, and that does not count against the annual exclusion of $14,000.” So, even if you send $20,000 a year to your grandchild’s college, the amount over $14,000 ($6,000 in this case) would not count against the lifetime exclusion.

The Bottom Line

Many people approach saving for college the same way they approach retirement: they do nothing because the financial obligations seem insurmountable. Many people say their retirement plan is to never retire at all (not a real plan, by the way). Similarly, parents might joke (or assume) that the only way their kids are going to college is if they get a full scholarship. Aside from the obvious flaw with this plan, it’s a back-seat approach to a situation that really needs a front-seat driver. Even if you can save only a small amount of money in a 529 or Coverdell plan, it’s going to help. For most families, paying for college is not as simple as writing a check each quarter. Instead, it’s an amalgamation of financial aid, scholarships, grants and money that the child has earned and money that parents and grandparents have contributed to tax-smart college savings vehicles.

No comments:

Post a Comment